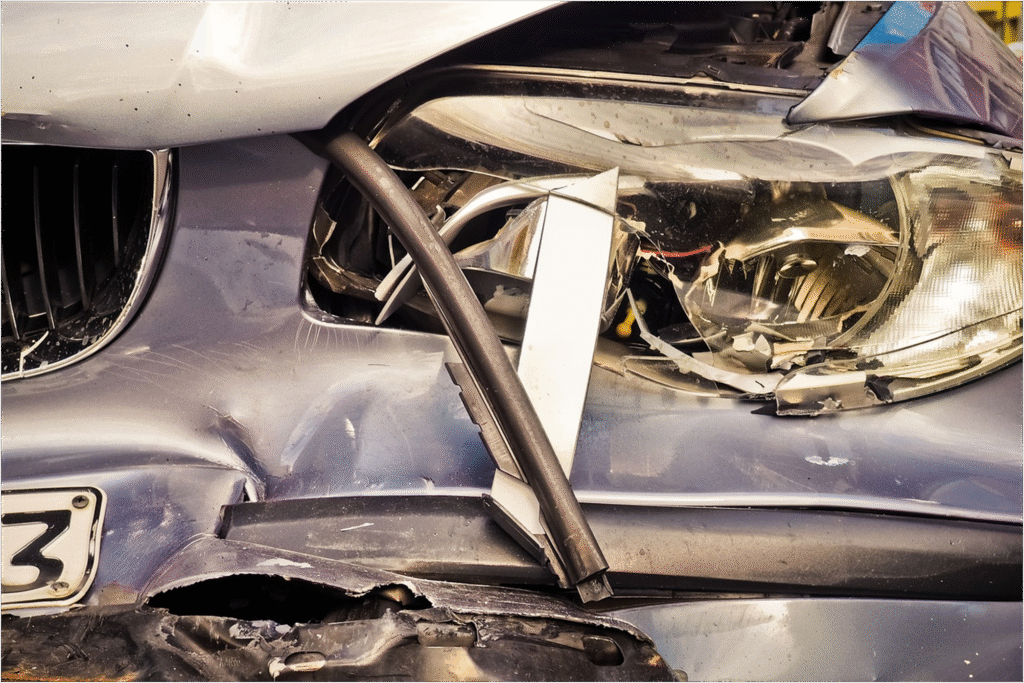

Dealing with insurance after a car accident can often feel like an overwhelming and frustrating experience. From the moment the accident occurs, you’re suddenly thrust into a world of paperwork, phone calls, and waiting—sometimes for weeks or even months—to get your claim processed.

The complexity of insurance policies, the need to provide detailed documentation, and the back-and-forth with adjusters can leave you feeling stressed and uncertain at a time when you just want things to be resolved quickly and fairly.

One of the biggest reasons this process is such a hassle is that insurance companies have their own procedures and priorities, which don’t always align with your need for timely compensation. You may find yourself navigating confusing terminology, disputing fault percentages, or dealing with delays as insurers investigate the claim.

Additionally, the emotional and physical toll of the accident itself can make it even harder to focus on these administrative hurdles, turning what should be a straightforward process into a drawn-out ordeal.

Navigating Car Insurance After a Crash

Navigating car insurance after a crash can be much smoother if you follow a few key steps.

Report the Accident Promptly

Contact your insurance company as soon as possible to notify them of the accident. Many insurers have strict deadlines for reporting claims, and early notification helps speed up the process.

Document Everything

Take photos of the damage to all vehicles involved, the accident scene, and any relevant road conditions or traffic signs. Collect contact information from other drivers, witnesses, and law enforcement officers. Keep copies of the police report and any medical records if injuries occurred.

Understand Your Policy

Review your insurance policy to know what coverage you have, such as liability, collision, or uninsured motorist coverage. This helps set realistic expectations about what expenses your insurer will cover.

Communicate Clearly and Keep Records

When speaking with your insurance adjuster, be honest and provide accurate information. Keep a detailed record of all communications, including dates, times, and the names of representatives you speak with.

Get Repair Estimates

Obtain repair estimates from reputable auto shops. Your insurer may have preferred shops, but you have the right to choose where to get your car fixed.

Don’t Rush to Settle

Avoid accepting a settlement offer immediately. Take time to review the offer carefully, and if needed, seek advice from a legal professional or a trusted advisor to ensure the compensation covers your damages fully.

Follow Up Regularly

Stay in touch with your insurance company to check the status of your claim. Persistent but polite follow-ups can help prevent unnecessary delays.

By staying organized, informed, and proactive, you can reduce the stress of dealing with insurance after a car accident and help ensure a fair resolution.

The Importance of Involving an Attorney

Involving an attorney after a car accident can be crucial to protecting your rights and ensuring you receive fair compensation. While insurance companies may seem helpful, their primary goal is often to minimize payouts, which can leave you at a disadvantage, especially if the accident resulted in significant damage or injuries.

An experienced car accident attorney understands the complexities of insurance policies, liability laws, and negotiation tactics, allowing them to advocate effectively on your behalf. They can help gather and preserve important evidence, such as police reports, medical records, and witness statements, which are essential for building a strong case.

They also handle communications with insurance adjusters, preventing you from inadvertently saying something that could hurt your claim. Moreover, if the insurance company denies your claim or offers an unfair settlement, an attorney can guide you through the appeals process or, if necessary, represent you in court.

In cases involving serious injuries or disputed fault, legal expertise becomes even more important. Attorneys can assess the full extent of your damages—including medical expenses, lost wages, pain and suffering—and ensure these are properly accounted for. Ultimately, involving an attorney provides peace of mind, knowing that a knowledgeable professional is working to protect your interests during a stressful and often confusing time.